Flavien Felder, IFF Institute of Federalism, University of Fribourg

Relevance of the Practice

One of the major political goals of the intercommunal equalization systems is to encourage a decentralized occupation of the territory and to find a balance between the urban and rural areas of the canton. The urban center of the Canton of Vaud (the City of Lausanne) and the other secondary urban municipalities (Vevey, Montreux, etc.) are attractive but the rural communes must also be seen as pleasant places to live.

| Article 1: (LPIC) Purposes of the law: a. Mitigate the inequalities in tax burden resulting from differences in contributory capacity, while guaranteeing the autonomy of the municipalities in terms of taxation; b. Do not hinder or even favor the mergers of Vaud municipalities; c.Provide municipalities with the resources they need to accomplish the tasks incumbent upon them by contributing to the sustainable balance of their finances; d. Distribute between the communes certain charges falling under the canton and the communes; e. Compensate the particular charges of the center cities; f. Allocate certain municipal charges among the municipalities, causing excessive disparities between the municipalities. |

This practice focuses on the intercommunal equalization system in place in the Canton of Vaud since 2011 as a result of new negotiations on the distribution of the competencies between the canton and the communes. It is a relevant practice for the LoGov project on urban-rural divide as local financial arrangements are at the core of intercommunal relations and the main purpose of the system is namely to find a balance between urban and rural municipalities in the canton. For a full list of the purposes, see the Article 1 of the Act on intercommunal equalization (LPIC) of the Canton of Vaud (free translation).

This practice is certainly also relevant for the other four Working Packages of the LoGov project but more specifically for report section 2 on the local responsibilities and public services and report section 5 on the intergovernmental relations since it provides useful information regarding the financing of the social costs and the so-called thematic expenditures: transport and forest management in the Canton of Vaud.

Description of the Practice

The State Council of the Canton of Vaud is responsible for implementing the cantonal Act on intercommunal equalization (Article 19 LPIC). Its Service of the Communes and Housing, within the Institutions and Security Department is in charge of its implementation. In addition, the Union des Communes Vaudoises (UCV), an association of municipalities[1] created in 1910 to safeguard the competencies of the communes and to promote their interests towards the Canton of Vaud, helps in generating the data and monitoring the system. Gianni Saïta, General Secretary of the UCV and author of the review ‘La Péréquation en Questions: 2020’[2] analyses the Article 1 LPIC to explain the whole system. He points out that letters a and c focus on the economic dimension of the equalization system while letter d integrates an additional element to it, namely the social cost that is to be covered by the cantons and/or the communes.[3] Letters e and f add two additional constraints to the system: the socio-demographic characteristic (economic burden on city centers) and the thematic expenses (forest management for example). Finally, point b underlines that transfers must be consistent with the public policy regarding municipal mergers.[4]

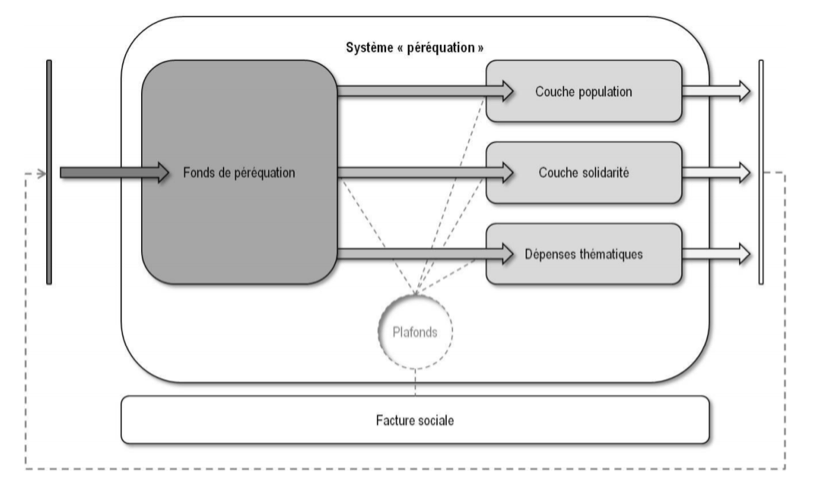

The above diagram represents how the five characteristics of the direct equalization system listed above operate in the Canton of Vaud and how they regulate the financial intercommunal relations.[5] At the entrance of the system, the communes contribute to the equalization fund (fonds de péréquation). The financial resources available in the fund are distributed to the communes according to three different layers: the population layer (couche population); the solidarity layer (couche solidarité) and the thematic expenditures (dépenses thématiques). In order to limit redistributions (output) and / or the contributions of municipalities to the equalization fund (input), the legislator puts in place three thresholds, called ‘caps’ (plafonds).[6] Finally, a large arrow with dotted lines wrapping the diagram shows that municipalities’ contributions (inputs) to the fund generate the redistributions to other municipalities (outputs).

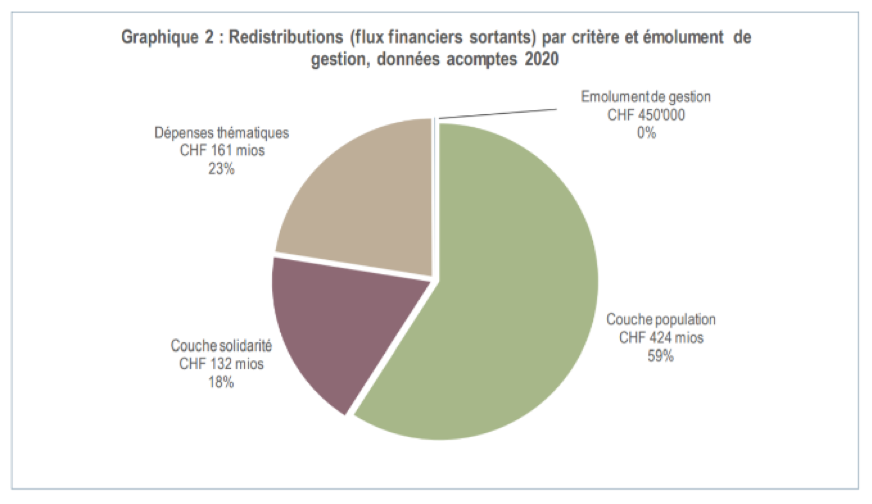

In 2020, the equalization fund of the Canton of Vaud will reach CHF 727 million (inputs). The redistribution (outputs) can be represented by the following diagram.[7]

The population layer (couche population) corresponds to a redistribution formula based on the number of citizens per commune. The basic idea is that a higher density increases the public sector spending. It is typically a way to cope with the challenge of commuters from suburbs to urban-centers.[8]

The solidarity layer (couche solidarité) relies on the hypothesis that the thinner the financial capacity of the commune, the bigger its difficulty to finance its public services. Therefore, a solidarity mechanism helps the poorer communes to cover the basic public services.[9]

The thematic expenditures (dépenses thématiques) are limited to two sectors in the Canton of Vaud: transport and forest management. And this mechanism covers only the management costs of the two sectors (no investment expenditures). The idea is to compensate both the urban-centers that are in charge of the public transports, school transports and road management as well as the rural municipalities that have the duty to manage their forests for the benefit of all.

The equalization caps (plafonds péréquatifs) are designed to keep the rich municipalities’ contributions to the equalization fund within certain limits that do not unbalance their public finances. First, the equalization efforts (input) cannot exceed a certain tax point (Article 8 LPIC). Second, the municipalities that have a high tax rate can claim compensations if they agree to reduce the tax rates (Article 6 LPIC). Third, the equalization contributions distributed to the poorer municipalities (output) cannot exceed a certain tax point (Article 7 LPIC).[10]

Assessment of the Practice

If the implicit practice objective is to encourage people to spread out in the whole territory of the Canton of Vaud, the explicit objectives are listed in Article 1 LPIC. One can see that both types of objectives are achieved. Nevertheless, in October 2019, the Court of Audit of the Canton of Vaud released an audit on the intercommunal equalization system and highlighted some dysfunction.[11] In particular, the heterogeneity of the data provided by the communes create equalization bias that must be corrected by a better management of the whole system.

References to Scientific and Non-Scientific Publications

Cour des Comptes du Canton de Vaud, ‘Audit des dépenses thématiques de la péréquation intercommunale et de la gouvernance de l’ensemble du dispositif’ (Report no 56, 2017) <https://www.vd.ch/fileadmin/user_upload/organisation/cour_comptes/1_Rapports_d_audit/56_Rapport.pdf>

Federal Department of Finance, ‘Le système fiscal suisse’ (17 edn, Swiss Tax Conference 2017) <https://www.newsd.admin.ch/newsd/message/attachments/48789.pdf>

Rühli L, Monitoring des Cantons 5: Le Labyrinthe de la péréquation financière (Avenir Suisse 2013) <https://www.avenir-suisse.ch/fr/publication/le-labyrinthe-de-la-perequation-financiere/>

Saitta G, ‘La Péréquation en questions: 2020’ (Union des Communes Vaudoises 2019) <https://www.ucv.ch/fileadmin/documents/pdf/Th%C3%A8mes/03-Economie-et-finances/P%C3%A9r%C3%A9quation/Perequation-en-questions-2020_PUB_UCV_2019-09-30.pdf>

[1] In 2020, it represents approximately 90% of the 309 communes of the canton (urban and rural).

[2] The document can be downloaded on the website of the Union des Communes Vaudoises, <https://www.ucv.ch/thematiques/economie-et-finances/perequations-financieres> accessed February 2020.

[3] We do not further discuss the letter das it aims specifically at the financing of the social cost and falls into the category of indirect equalization (the system takes into account the fiscal capacity of the communes but does not include a redistribution mechanism).

[4] Gianni Saitta, ‘La Péréquation en questions: 2020’ (Union des Communes Vaudoises 2019).

[5] ibid.

[6] The social cost (facture sociale) and its calculation belong to the system but are not further discussed here.

[7] Saitta, ‘La Péréquation en questions’, above.

[8] Saitta, ‘La Péréquation en questions’, above.

[9] ibid.

[10] ibid.

[11] The document can be downloaded on the website of the Union des Communes Vaudoises <https://www.vd.ch/fileadmin/user_upload/organisation/cour_comptes/1_Rapports_d_audit/56_Rapport.pdf> accessed February 2020.