Dalilah Pichler, KDZ Centre for Public Administration Research Austria

Relevance of the Practice

The intragovernmental transfer system within the Austrian fiscal equalization mechanism provides a certain particularity in its outcome under the aspect of the urban-rural divide. From shared revenue and own taxes, urban local governments (ULGs) at first have an increased financial strength per capita compared to rural local governments (RLGs). However, the intragovernmental transfer system between the municipalities and their respective regional governments (Länder) shifts financial strength per capita substantially towards smaller local governments (LGs) at the expense of larger municipalities. This raises the question on how such a financial arrangement considers the different financial needs of RLGs and ULGs and shall be assessed in this entry.

Description of the Practice

The shared revenues are transferred to municipalities within the framework of the Fiscal Equalization Act (Finanzausgleichsgesetz, FAG) as a share of the federal taxes (such as value added tax, income tax, etc.). The tiered population scheme is used to compensate larger municipalities for the additional expenditure as regional or urban centers. While each municipality independent of its size finances the basic public services such as water supply, wastewater and waste management with cost-effective fees, the shared revenues can be used for other, less cost-effective public services. Regional or urban centers typically offer more public facilities for sports and leisure, child care services and cultural activities. These are also used by the residents of the surrounding municipalities within the commuter belt. Therefore, the idea of the tiered population scheme is that large cities receive a higher share of the revenue per capita than small municipalities without a corresponding function as regional center.

An essential indicator for the financial performance of a municipality is the financial strength per capita. This shows the extent to which a municipality can meet its financial needs from its own taxes (especially municipal tax and property tax) and shared revenues. The higher the financial strength per capita, the better a municipality is equipped with financial resources and can thus secure ongoing operations, but also make investments. However, the complex transfer system between municipalities and regional governments – which comes after the national distribution of shared revenues – leads to significant shifts in the financial resources of municipalities. On the one hand, regional governments receive current transfers from each municipality based on their financial strength per capita. Therefore, the more financial resources a local government has, the more it has to pay into these ‘regional funds’. These transfers are mainly used for expenditures of hospitals or social welfare, which are services provided by the regional government. On the other hand, municipalities also receive capital transfers for investments. These typically co-finance infrastructure projects such as roads, public buildings or protective structures against natural disasters. Also current transfers from the regional governments are possible, e.g. to foster regional cooperation, co-finance child care expenses, support municipalities if they cannot reach a balanced budget or fund economically disadvantaged regions.

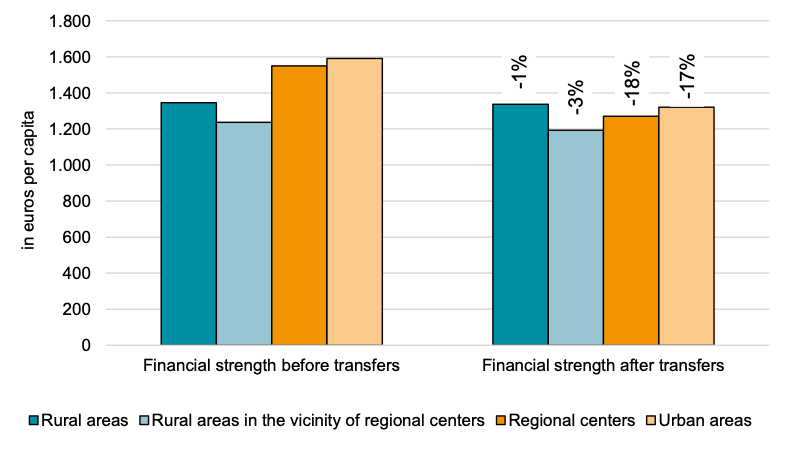

Overall, the intragovernmental transfers show a strong balancing effect of financial resources. The result of this regulation is a reduction of the differences in financial strength between the municipalities and a shift of funds from financially strong to financially weak municipalities. The impact of this transfer system on the municipalities financial strength is therefore significant. The above figure depicts the disproportionate burden for regional centers and urban areas. On the left, the financial strength before transfers shows a higher financial strength for regional centers and urban areas. The right part depicts the same indicator after intragovernmental transfers. The financial strength is reduced by 18 per cent in regional centers and 17 per cent in urban areas. However, as the majority of Austrian municipalities are categorized as rural areas (59 per cent) and rural areas in the vicinity of regional centers (26 per cent),[2] the impact of transfers within these categories is not visible. In total, the transfer system equalizes the financial strength in an urban-rural typology, not regarding the different services urban and rural areas provide.

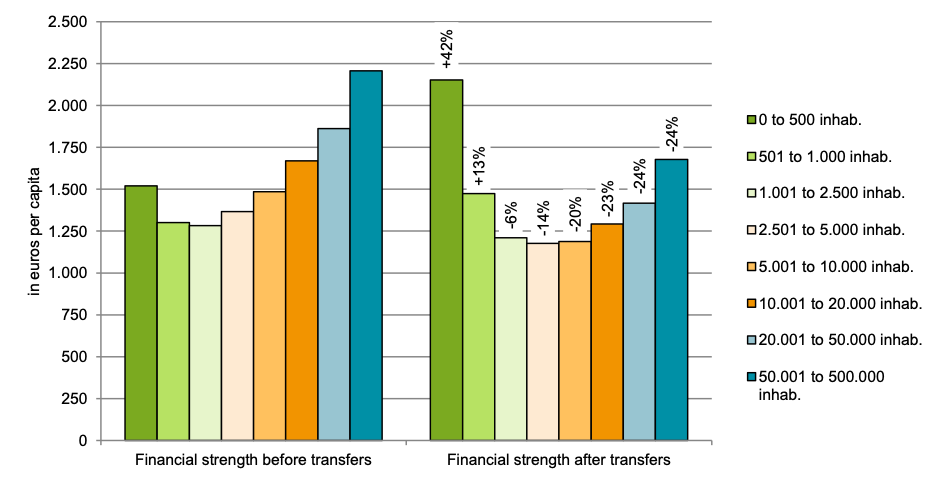

The next figure additionally shows the effect of the intragovernmental transfers between municipalities and their regional government according to population size. The left part of the figure (financial strength before transfers) shows that the financial strength per capita basically increases with the size of the municipality. The fact that the smallest municipalities with up to 500 inhabitants have higher values is due to the high proportion of touristic municipalities, which can fall back on higher own tax revenues. The increase in financial strength per capita, especially from 10,000 inhabitants onwards, is due to the tiered population scheme in the context of fiscal equalization of shared revenues.

In 2019, the municipalities paid EUR 3.7 billion as transfers to the Länder, in particular current transfers for hospitals, for welfare and a so-called general duty for the Länder. In return, EUR 1.8 billion flowed from the Länder to the municipalities mainly through capital transfers and partly as current transfers. In sum, 35 per cent of the municipalities’ revenue shares from the national fiscal equalization process are reduced on average after the regional transfer system.[4]

The right part of the above figure shows the financial strength after transfers. It can be seen that the financial resources according to population size change significantly as a result of the transfer system. There is a U-shaped form, as the financial strength of smaller municipalities with up to 1,000 inhabitants is increased. The per capita financial strength of the average municipality with up to 500 inhabitants increases by 42 per cent, that of the average municipality with up to 1,000 inhabitants by 13 per cent. In all other population classes, there is a decrease of financial strength. For municipalities with over 5,000 inhabitants, the reduction is between 20 to 24 per cent.

Assessment of the Practice

The fiscal equalization mechanism distributes the shared revenues to all levels of government. Because of a tiered population scheme, larger municipalities receive a larger share of these revenues. The original financial resources from the fiscal equalization are significantly changed based on the intragovernmental transfer system between Länder and their municipalities. This practice reduces the municipal autonomy by limiting the financial leeway. Also, it reduces the financial strength of medium-sized and large cities. It is true that small municipalities in rural areas struggle with thin settlement structures or provide large infrastructures for tourism. However, medium-sized cities have to maintain the function as a regional center, providing infrastructure in different areas of public interest for the surrounding municipalities.

Linking financial resources and actual public service provision is currently not planned, even though a financial equalization scheme with a stronger orientation towards actual service provision has been in discussion for a long time. In particular, there is a call for more transparency and the reduction of complexity through a harmonized framework for all regional governments.[5] A linkage between municipal tasks to be fulfilled as part of (mandatory) public service delivery and finances would ultimately lead to improved management and more efficient and effective use of resources.

References to Scientific and Non-Scientific Publications

Bauer H and others, ‘Grundsätzliche Reform des Finanzausgleichs: Verstärkte Aufgabenorientierung‘ (IHS, KDZ, TU Wien 2010)

Berger J and others, ‘Förderung strukturschwacher Gemeinden im Rahmen des Finanzausgleichs‘ (Eco Austria 2014)

Bröthaler J, Haindl A and Mitterer K, ‘Funktionsweisen und finanzielle Entwicklungen im Finanzausgleichssystem‘ in Helfried Bauer and others (eds), Finanzausgleich 2017: Ein Handbuch (NWV 2017)

Hocholdinger N, Mitterer K and Seisenbacher M, ‘Zentralörtliche Funktion in OÖ Städten und deren Abgeltung im Transfersystem ‘ (KDZ 2020)

Mitterer K, ‘Berücksichtigung besonderer Lasten von zentralen Orten im Kärntner Transfersystem‘ (KDZ 2018)

Mitterer K, Biwald P and Haindl A ‘Länder-Gemeinde-Transferverflechtungen – Status und Reformoptionen der Transferbeziehungen zwischen Ländern und Gemeinden‘ (KDZ 2016)

Mitterer K and Seisenbacher M, ‘Gemeindefinanzdaten 2021 – Entwicklungen 2009 bis 2022 ‘ (Österreichischer Städtebund 2021)

[1] Own adaptation, based on Statistik Austria, ‘Gemeindefinanzdaten’ (2019).

[2] Based on urban-rural typology of Statistik Austria 2016.

[3] Mitterer and Seisenbacher, ‘Gemeindefinanzdaten 2021‘, above.

[4] Mitterer and Seisenbacher, ‘Gemeindefinanzdaten 2021‘, above.

[5] Bröthaler and others, ‘Funktionsweisen und finanzielle Entwicklungen im Finanzausgleichssystem‘, above.